The Author – Bart Busschots

Site Search

Site Map

- Blog

- Publications

- Software

Blog Categories

- Computers & Tech

Featured Tags

Creative Commons

Unless otherwise stated, the content on this site is licensed under Creative Commons Attribution, Noncommercial, No Derivative Works 3.0 License

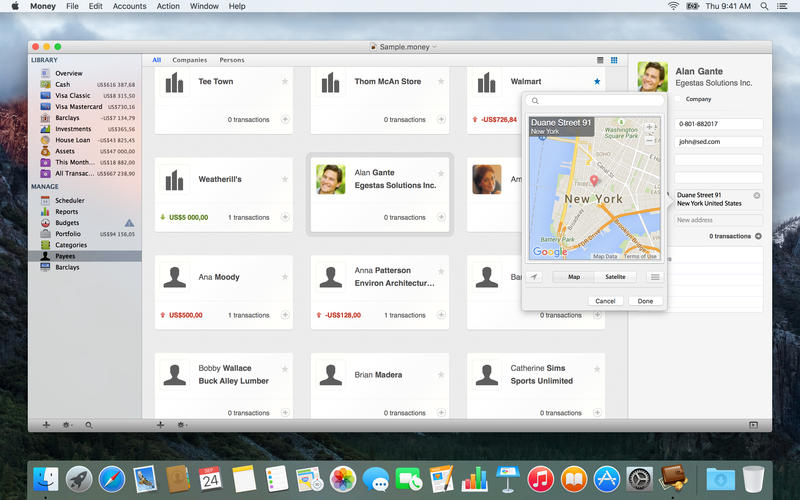

Money offers 13 types of reports, including Spending by Category, Net Worth, and more. See your financial situation appear right before your eyes. Store Money documents in your Dropbox account to access and edit them from any of your devices, at home or on the go. What's New in Version 4.7.5: OS X Sierra compatibility improved. Forgot Password? Create an account now.

Filed Under Computers & Tech on July 24, 2010 at 2:19 pm

THe week before last I posted a description of the final stages of my quest for a new personal finance app, and explained how I came to choose Money3 from Jumsoft, what I didn't do was actually review the product though, so I thought I'd do that now. On the one hand I've only been using this product for a week and a half, but on the other I've been using it a LOT during that week and a half. In that time I've entered all the transactions for 2010 on six accounts covering all my personal and business transactions so far this year. That's a lot of time using the software, so I think I've got a good flavour of what it's like to really use it.

On the whole the app behaves and looks like a true-blue Mc App, and more importantly, it works well, and for the price, I'm really happy with the functionality it offers. My previous app was Cha-Ching 1.X, and there's no doubt that Money is a lot less playful an app, and that it feels a lot more business-like. To be honest though, I don't think that's a bad thing. Cha-Ching sometimes felt like a toy app, this feels like a grown-up mature app. Money is not cluttered or intimidating though, but it definitely feels more utilitarian. You also get the impression this app has been the beneficiary of a few more development cycles than Cha-Ching. It feels a lot more polished and fine-tined than the nascent Cha-Ching.

Before I get stuck into some of the things I really like about Money, I should also point out some of it's foibles. In my mind the most glaring omission is a lack of support for tagging/keywording. I've become very fond of tags/keywords, and I really miss them in organisational apps like Money (and iTunes). In Cha-Ching I had set up quite a few Smart Accounts which were triggered by keywords or combinations of keywords, and these had become an important part of my workflow. Thankfully I was able to re-create these same Smart Accounts in Money, but not as elegantly. I had to basically simulate tags/keywords by adding words or phrases in the description field, and then searching for those in my Smart Accounts. This mean you don't get auto-complete on your ‘tags', and it's also much more prone to typos. I have a working solution, but this is the one area where I find Money inferior to Cha-Ching.

My only other complaint is a minor one, but it was initially very frustrating. When you enter a transaction you do so in an overlay that pops up over your list of transactions, and as you create your transaction you tab through it from field to field. That is until you come to the drop-down for choosing the transaction's Category. One nice thing about this drop-down menu is that you can type in it and it begins to auto-fill and scroll the list for you. The problem comes when you want to select an item in the list after you've expanded it by hitting the down-arrow. My reflexive action for selecting the value and collapsing the menu was to hit return. This is the WRONG thing to do! It commits the transaction as-is, and at this point in the proceedings you haven't entered an amount, a payee or a description yet! The correct way to select a value an collapse the list is to click on it or to hit tab, which I find counter-intuitive. It took me a fair few empty transactions to get over my reflex to hit enter and learn to hit tab instead, but after a few hundred transactions I think I have it down now 🙂

So, what do I like? Since the only other personal finance app I've ever used extensively was Cha-Ching 1.x, I can't avoid drawing comparisons to it when describing Money. The biggest change is that the display of transactions is much more compact and hence easier to scan through in Money. Each transaction is just one line, so it looks much more like a spreadsheet. I can easily see fifty or more transactions on a page with Money, while you'd be lucky to get twenty with Cha-Ching!

Another fantastic improvement is a running total column next to the amount column. This sounds so trivial and so obvious, but Cha-Ching was totally lacking it. It makes accounts much easier to reconcile, and mistakes much easier to find.

Money By Jumsoft 4 7 40

The biggest advantage for me though is robust transfer support. In Cha-ching you could not easily transfer money between your own accounts. You had to do it as two completely independent transactions, a withdrawal from one account, and a deposit into the other. This made editing a transfer a nightmare, because you had to find the two un-linked parts and edit them individually. In Money the transactions are linked so you only need to edit the details in one place. Additionally, Money makes it easy to jump from one half of a transfer to another by adding an in or out arrow next to the amount in the amount column that acts as a link to the other half of the transaction in the other account. I transfer around a lot of money between my personal account, my credit card, and my business account as I buy business stuff on my personal credit card and then pay myself back from my business account, so good transfer support is a big deal for me.

Another nice feature is the ability to program in recurring bills. It's great to be able to see what bills are due out of what account when. This makes it easy to ensure there's always enough money in the right place at the right time to avoid referral charges and un-necessary overdraft interest charges. I should point out that this is a feature Cha-Ching has too, and to be fair, I found their interface for it marginally easier to use than Money's, but just marginally.

It's hard to get excited about a personal finance app, so it's no surprise that I don't crave for time using Money, but I will say it's made an otherwise painful task a little less unpleasant, which I quite high praise for personal finance software in my book!

Money By Jumsoft 4 7 49

- Connor P on July 25th, 2010 3:23 am

Second paragraph:

You also get the impressive this app

Should that be Impression?

C

- George in Tulsa on July 26th, 2010 4:46 pm

Hey, Bart, glad you found Money heaven.

I downloaded Money3. I really, REALLY like its ability to import and export to CSV.

I imported a large Quicken file via QIF. Seamless.

Here's where I ran into real trouble, which probably won't apply to you or most users.

In Quicken, I can create different SELF-CONTAINED files. That means, on a simple basis, I can keep separate files for my wife and me, another for the daughter, another for the son.

In a more complex universe, when I was being paid for financial and tax work, I could keep separate Quicken Files for each client.

But as best I can tell, nothing similar is possible in Money3. It seems to be a front end to an SQL type ( probably SQLite ) database, much as Bento is, and Bento won't let a user (easily) have different data files.

The trick to having different Bento data files is to create a Bento database, then back it up and rename the backup something unique. When the backup is restored, the old database is obliterated (back it up, first!) and replaced.

Money3 seems to work the same way. Just unfortunately cumbersome and a real chance to obliterate the wrong file.

If you have a better way to accomplish that, please let me know!

G

- Bart B on July 26th, 2010 6:51 pm

Thanks Connor – fixed that!

George – that's a good point. Not something I noticed, but I just look after stuff for me. If I were in your situation I'd set up OS X accounts for each person, and use fast user switching to move between them as needed.

Bart.

- cc on August 1st, 2010 5:45 am

that was a really nice review! i've been a money user on pc for eons, but i've switched over to mac and considering my options too for my iphone… have u also looked at squirrel? seems like there's a buzz about that one but i don't have time to give them all a try before i decide on which one to use!

cc

- cc on August 1st, 2010 5:54 am

sorry, just read your … part 2 blog and found the answer to my question!

thanks!

cc

- George in Tulsa on August 10th, 2010 1:16 am

Bart – don't user accounts take like 2 GIG minimum? Even in these days of huge hard drives, I try to hold the user accounts on my computer to as few as are really required. Main administrator, and a couple of 'standard' users.

. . . and say I had 10 tax clients. 10 user accounts open simultaneously for flipping through? 10 user accounts to back up separately?

ingenious, yes, but not really practical.

G

- Bart B on August 10th, 2010 12:23 pm

Hi George,

I really don't think they do. Why would an empty account take up anything more than a few KB, and most perhaps a few MB for some plist files. It would be a quick experiment to just create a blank account and see how much space it really does use. I expect it to be very little.

Bart.

- debra on August 14th, 2010 5:56 pm

I downloaded money3 to look at but then decided I didn't want to start my 15 day trial offer, so I tried to close the program. I tried, and I tried, and I tried. The x wasn't highlighted. In the dock right clicking then hitting quit didn't work. Trying to shut down my Mac wouldn't work because Money3 was in use. I was being forced to 15 day Try, Enter License or Buy. I'm still trying to shut down and I see my only option as a hard shut down. Any suggestions? I'm new to Mac and not the most tech savvy, but I thought I knew how to stop a program I don't want to run.

- Bart B on August 14th, 2010 6:00 pm

Hi Debra,

They really should have a cancel button on that!

Anyhow, you should be able to avoid a hard shutdown. The first thing I'd try would be the force quit applet. Click on the apple logo in the top-left of the screen, and from that menu choose 'Force Quit …' That will open a new window with a list of all running apps. If you select Money and then click the Force Quit button, it should close.

Hope that helps, Brackets download.

Bart.

- Ignazio on February 13th, 2011 3:47 pm

Downloaded money3 and imported about 10 years of MsMoney transactions; went real smooth.

What I miss from msmoney (I was still using version 2000) are all the reports I had. in jumsoft's software reports are almost unusable.

Tried to contact the developer, but answer was 'that's it'

Any idea?

Thanks - Jared on May 25th, 2011 3:30 am

I'm nearly a year late to this conversation…

I've been searching high and low for a good Mac PFM solution. I have tested Quicken Essentials, iBank, and MoneyDance. Each has things I like and dislike. I have a fairly complex financial situation (rental property in the US, live in a foreign country, need multiple currency support – 6+ accounts in two currencies, income in two different currencies…. You get the point.

So far it seems that Money can handle all that. However I've been testing Money4 Beta and just barely opened Money 3.6.7 trial. I'm going to keep plugging away and I'll update you when I'm done, but I must say that so far I'm impressed…

- Bart Busschots on June 10th, 2013 1:38 pm

Since this post is attracting a lot of SPAM, and since the review covers a now out-of-date pice of software, I am closing the comments thread.